The Future of Central Business Districts Depends on More Than Office Buildings

Nearly four years after the pandemic began, central business districts (CBDs) are grappling with complex, intertwined challenges related to business closures, reduced foot traffic, and, in some areas, widespread office vacancies. Research conducted by the University of Toronto’s School of Cities shows that the recovery rate is largely due to the diversity of downtown economies. CBDs that attract a variety of residents (people who live in their CBDs), employees (people who are employed at a business or organization in their CBD), and local visitors (people who neither live nor work in their CBD but live in the city proper) are thriving, while downtowns dominated by professional services lag behind. Gensler’s latest City Pulse study surveyed 26,000 urbanites in 53 cities across six global regions to understand how downtowns can appeal to each of these CBD personas and enter a new age of vitality.

Families are having the best experience of all downtown residents.

The majority of downtown residents (people who live in CBDs) agree that their CBD provides a great experience — the highest percentage of any CBD persona. When looking at the data by household composition, we found that respondents who live in households that include family members are more satisfied with their CBD experience than those who live with partners, roommates, or alone. Families with children are having the best experience of all household typologies.

While current CBD residents are having a great experience, non-residents are significantly less likely to agree that their downtown could support them across various life stages. Residents are 1.4x more likely than non-residents to think that their CBD is a great place to live, and 1.6x more likely than non-residents to think that their downtowns are a great place to start a family and raise children. To attract and retain new residents, CBDs need to reposition themselves as thriving, livable urban cores for all generations and household structures.

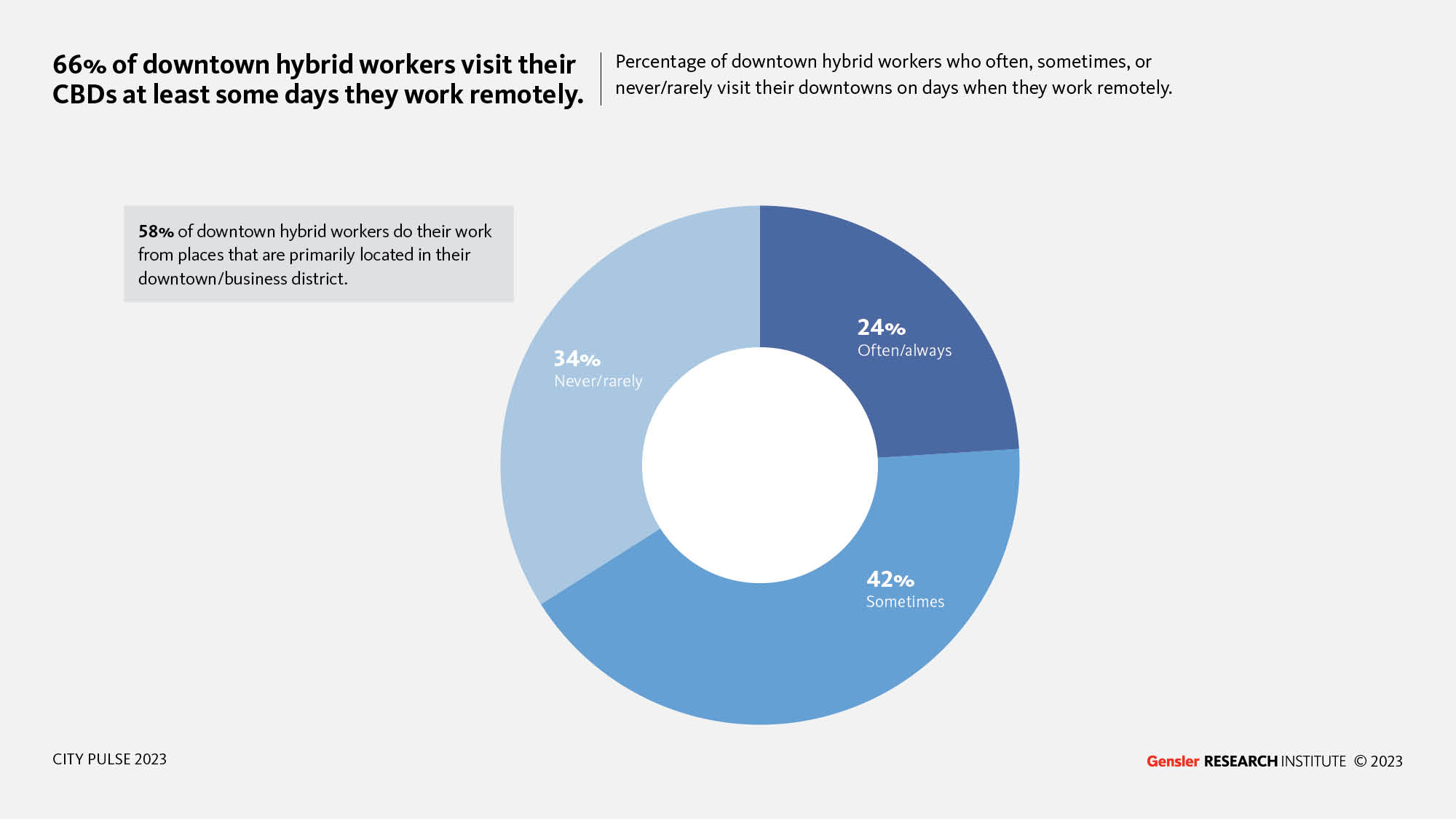

Hybrid workers haven’t abandoned their CBDs.

Much of the decline of central business districts — and city economies a whole — has been attributed to the rise of the hybrid workforce. However, as urban centers emerge from the immediate aftermath of the pandemic, hybrid workers have not abandoned or lost enthusiasm for their downtowns. 66% of hybrid CBD workers visit their CBDs at least some days they work remotely. And 58% of downtown hybrid employees work from cafes, coworking spaces, and other third places in their CBDs.

Downtown employees — whether full-time in the office or flexible — want CBDs to support more than just work. Both hybrid and non-hybrid CBD employees want more outdoor recreation, shopping, and culture within their downtowns. 88% of hybrid downtown employees and 73% of non-hybrid downtown employees would visit their CBDs more if their desired changes were implemented.

Local visitors to downtowns rate their CBDs lower than residents or employees — CBDs need to close the experience gap to reach this untapped market.

Local visitors (respondents who neither live nor work in their CBDs but live in the city proper) rank their downtowns lower than other CBD personas on every experience attribute. They are also the least likely of any persona to feel that their CBD is iconic, grand, or blends in with the surrounding neighborhoods, and the least likely to feel that their downtown is social media worthy.

Only one in five visit their CBD at least once a week or more, and the rest go less frequently. Our analysis reveals that local visitors would go downtown more frequently if three key areas are improved: safety, parking, and exploration. Attracting a greater number of local visitors downtown more frequently will help ensure and sustain the economic recovery of CBDs.

Examining the preferences of CBD residents, employees, and local visitors provides key insights into how downtowns can best position themselves for the future.

The importance of downtowns cannot be overstated. According to our latest City Pulse data, people who feel that their CBD provides a great experience are 79% more likely to say that their city as a whole provides a great experience. CBDs must provide recreation, opportunities for discovery, and beautiful surroundings to continue to appeal to city dwellers. More broadly, downtowns must provide a diverse set of experiences — and appeal to a diverse set of user personas — to stay resilient. Making these alterations will help ensure that downtowns shift from central business districts into hubs for connectivity, recreation, and discovery.

For media inquiries, email .