From Pilots to Policy: Exploring Office-to-Residential Conversions in Boston

July 19, 2023 | By Todd Dundon, Jared Krieger

Like many cities across the U.S., Boston is facing a major housing crisis. As increasingly high demand for limited inventory continues to drive residential prices through the roof, local city and statewide administration have made housing a priority. At the same time, architects and developers are working to find creative solutions to make our cities more livable. One question in particular is top of mind: What should be done with all the empty office space in many of those same cities?

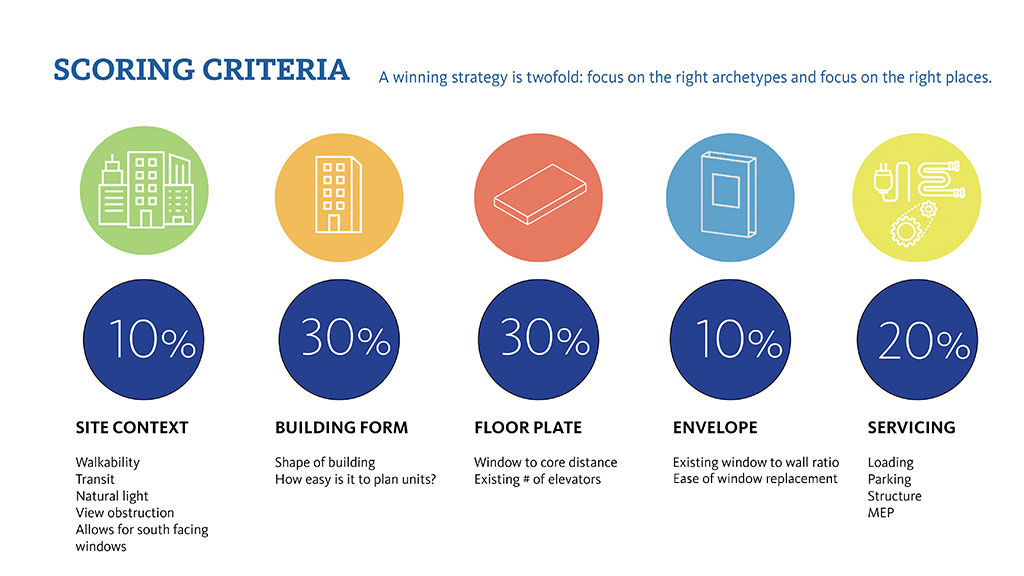

From a real estate perspective, there are clear steps that can be taken to address the housing shortage, and we believe there is huge opportunity in office-to-residential conversion. Several years ago, Gensler created a building rating system and cost model to assess and score vacant office compatibility for adaptive reuse, conversion, and redevelopment. Through our building conversions data collection, we are able to identify the consistent trends and characteristics that make one property a better candidate over another. This allows us to quickly identify which buildings are candidates for successful conversion, increasing value and return on investment.

Since first developing our algorithmic-based scorecard approach to assessing a property’s viability for conversion, we have scored over 900 buildings across North America, including built conversions. The additional data points have enabled our building conversions scorecard to improve and adjust results based on learnings.

To date, we have scored 90 buildings in downtown Boston. Of the 90 buildings, 30–40% scored high enough that they warrant further consideration for conversion. By that measure, we are looking at anywhere between 3 and 5 million square feet of convertible area, based on scoring just those 90 buildings in downtown Boston.

Unlocking Boston’s Latent Opportunity

According to Colliers 2023 Q2 report, Boston’s office vacancy is just about 20%, the highest in the 15 years since the 2007-2008 Global Financial Crisis. The city’s Class B office market is faring even worse, with a rate of 27% vacancy.

A recent analysis by the University of Toronto’s School of Cities of anonymized mobile device connectivity found that foot traffic around Boston’s Financial District is barely half of what it was pre-pandemic. The sluggish recovery is attributed not only to the prevalence of remote work within the financial services and tech industry but also to the city’s lack of housing.

Notably, only 4% of the historic downtown is residential, presenting a significant opportunity to convert multiple underutilized office buildings into much-needed housing units in the city — because sometimes bad office can make good residential. The benefits for converting are significant and multifold:

- Adding housing stock will help affordability.

- More residential downtown will spur multifaceted growth by adding 24/7 occupants to the predominately 9-5 weekday district.

- The most sustainable building is the one we do not tear down, which explains the many environmental advantages to converting older assets into housing.

- Time is money. In addition to the embodied carbon savings, when a building scores high on our database, keeping at least the structure will save a considerable amount of time (as compared to having to demolish and rebuild a completely new structure).

- Though Boston is not yet fining landlords whose buildings aren’t energy compliant, it’s only a matter of time before these enforcements come to fruition through the adoption of Boston’s Building Emissions Reduction and Disclosure Ordinance. In these instances, landlords will be faced with the decision of paying enormous sums to upgrade office buildings to be energy compliant, or to convert older Class B and C assets.

- Most older buildings will require significant façade, glazing, and mechanical systems to meet future energy codes, which can all be costly. So, landlords will be met with a choice: to spend the money to make Class B and C office buildings energy compliant and appealing to clients, or to spend that money on a conversion.

- The gap between rent per square foot in residential and office has been narrowing since 2020, and some will find it prudent to convert these older assets into residential, which is a more active market anyway.

Pilots and Policy Changes

Boston Mayor Michelle Wu recently announced a residential conversion pilot program that the city hopes will incentivize lenders, building owners, and developers to convert underutilized commercial buildings in downtown Boston to much-needed housing. The program would allow for building owners to switch from a commercial property tax rate to a standard residential property tax rate. In addition, properties would then be eligible for a rate reduction of up to 75% on the lower residential rate for a period of up to 29 years.

While we applaud this first step, the final decision on embarking on a conversion often comes down to the simple math of rent-per-square-foot that a building can yield. Like many cities, we are dealing with high construction costs, a complex zoning process, higher cost of lending (which funds most of these projects), and continued uncertainty about policy changes. As we have seen in other cities, additional support is needed to overcome these complexities. Since the announcement, we have received many calls from clients, developers, and investors. It remains to be seen if this incentive will bridge the gap.

Municipal leaders and policy makers can consider other incentives that make office-to-residential conversions a more attractive proposition to developers, such as:

- Boston could adopt an expedited zoning process for office-to-residential conversions. The current process can be complex and time-consuming, making it difficult for these projects to pencil out. Simplifying this part of the entitlement process could encourage more developers to make up-front investments.

- As energy codes continue to get stricter, the city could offer incentives including cash grants, waived permit fees or development charges, or additional property tax abatements over a period of time for projects that meet certain sustainable criteria.

Learning From Other Cities’ Successes

Boston can look to the Canadian city of Calgary as a primary example of how to successfully convert vacant office spaces into housing. After Gensler’s citywide conversion analysis, Calgary made changes to its policies and incentives to encourage conversions and create a better balance of uses in the city’s downtown core.

Calgary’s Downtown Development Incentive Programs provided for an initial investment of $200 million for a downtown revitalization plan, with $45 million for incentives towards the conversion of existing office space to residential, redevelopment, or adaptive reuse, including up to $75 (Canadian Dollars) per square foot contributing to the hard cost for such conversions. This made the projects more likely to pencil for developers. It also cut about 12 months off the lifecycle of projects from start to finish by removing some of the red tape associated with rezoning. As a result, new projects already underway are expected to increase Calgary’s downtown population by about 24%.

Another success story closer to home is Franklin Tower in Philadelphia, which transformed 24 floors of a vacant, outdated office building into modern residential units, complete with 13,000 square feet of street-level retail and a 7,000 square-foot rooftop space. This completed office-to-residential conversion is an excellent example of what Boston could accomplish.

There are many reasons why we can and should lead the way in revitalizing downtown Boston. As the city grapples with aging and underutilized buildings, high office vacancy rates, and significantly reduced foot traffic downtown, conversion to residential use presents a compelling option. If we have the stock, why not use it? Repurposing even a handful of buildings could help catalyze a more vibrant and active 24/7 neighborhood. By learning from successful conversions in other cities and implementing strategic policies and incentives, Boston can create more housing, achieve greater equity, and implement environmentally conscious solutions to revitalize our city.

If you would like to know more about our office-to-residential conversion scorecard, would like us to score your building, or identify which buildings make the best candidates for residential conversion in the Boston area, please reach out.

For media inquiries, email .